In recent news, China, Russia and India have made a groundbreaking announcement that they will be implementing a common digital currency backed by gold. This move is expected to have a significant impact on the global economy, especially considering that these three countries make up more than 40% of the world’s population. In this article, […]

Central Banks Continue to Buy Gold: 52 Tons Added in February

Gold has long been a valuable and highly sought-after commodity, and recent news suggests that central banks worldwide are taking notice. In February alone, global central banks added 52 tons of gold to their reserves, marking the eleventh consecutive month of net purchases. This trend has not gone unnoticed by people around the world, and […]

(Well) what do you know! ‘Sound money’ bill requires the Federal Reserve to return to the Gold standard

On March 30, 2023, three U.S. Congressmen introduced a pivotal sound-money bill. The bill aims to promote economic stability by restoring the U.S. dollar’s purchasing power and ensuring that it is backed by gold. This article will examine the bill’s potential impact, the history of sound money, and why it is essential for a healthy […]

Mexico Plans to Join BRICS Amid Growing U.S. Tensions

Mexico is exploring the possibility of joining the BRICS group of nations, a move that could significantly shift the country’s foreign policy and its economic relations. The move comes amid growing tensions with the US, Mexico’s longtime trading partner, and the country’s search for new allies in the global arena. Introduction The BRICS group of […]

JP Morgan Calls for Re-distribution of Wealth: “You will own nothing and you will be happy” anyone?

The recent call for the redistribution of wealth by JP Morgan has raised eyebrows and stirred controversy, with many drawing comparisons to the World Economic Forum’s infamous “you will own nothing and you will be happy” statement. In this article, we will explore the implications of JP Morgan’s proposal, examine the similarities and differences between […]

Sen. Ron Johnson to Janet Yellen: “You are going to drive the debt to $50 Trillion? “

Introduction Sen. Ron Johnson, a Republican senator from Wisconsin, recently engaged in a heated exchange with Janet Yellen, the United States Secretary of the Treasury. In a Senate hearing, Johnson expressed his concern about the country’s increasing debt and the potential consequences of Yellen’s policies. The senator questioned whether Yellen’s policies would drive the national […]

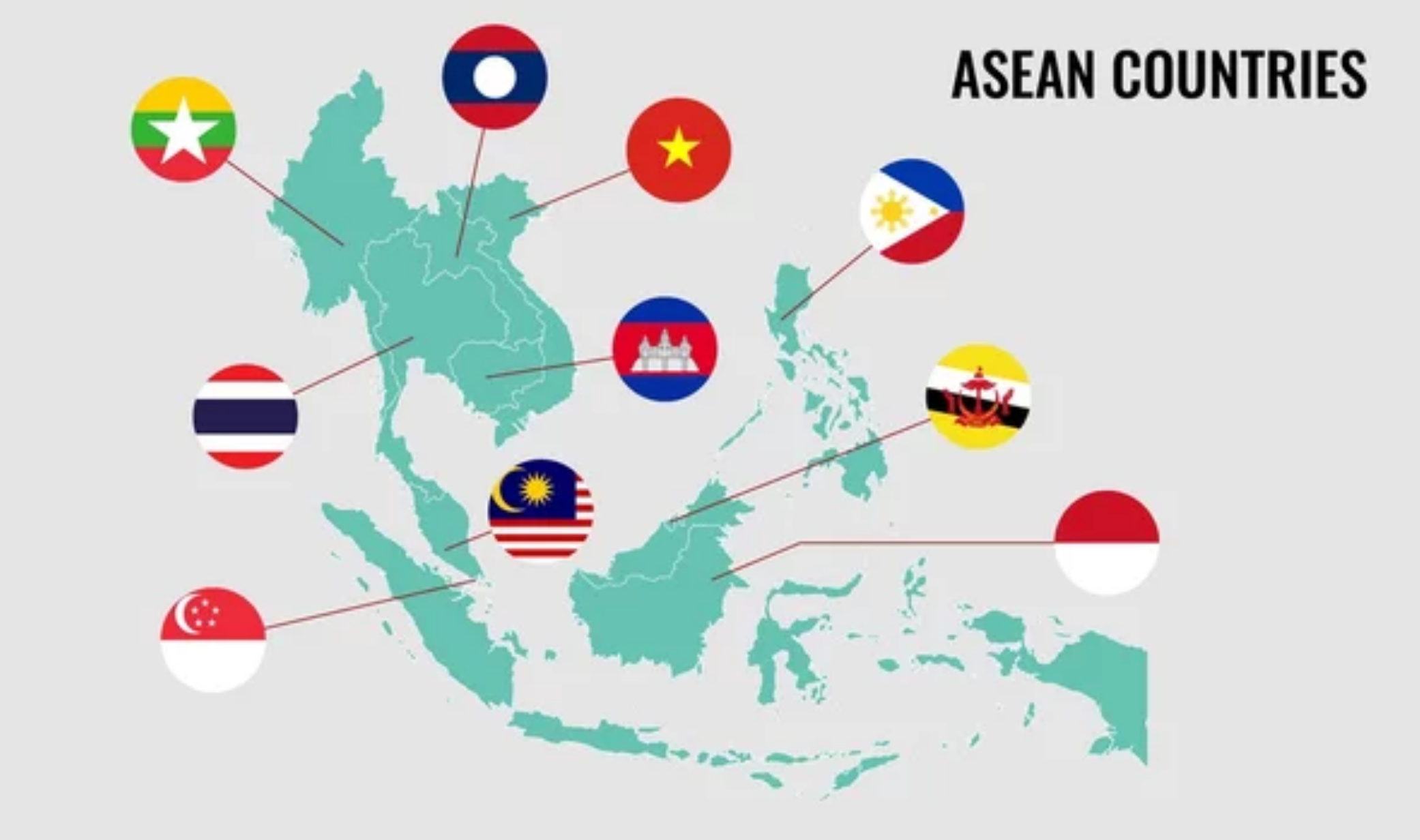

ASEAN Finance Ministers Consider Dropping the Dollar and Phasing Out Visa & Mastercard

The Association of Southeast Asian Nations (ASEAN) is a regional intergovernmental organisation comprising ten countries in Southeast Asia. In recent years, there has been increasing interest among ASEAN members to reduce their reliance on the US dollar and explore alternative payment systems to VISA and Mastercard. This article discusses the reasons behind this move and […]

Why are China, Russia, India, Saudi, Iran and Japan Dumping the Dollar

In recent years, the world has witnessed a significant shift in the global economic landscape. With the rise of China, Russia, India, Saudi Arabia, Iran and Japan as major players in the global economy, there has been a gradual shift away from the traditional reliance on the US dollar as the world’s reserve currency. In […]

Why are China, Russia, India, Saudi, Iran and Japan Dumping the Dollar

In recent years, the world has witnessed a significant shift in the global economic landscape. With the rise of China, Russia, India, Saudi Arabia, Iran and Japan as major players in the global economy, there has been a gradual shift away from the traditional reliance on the US dollar as the world’s reserve currency. In […]

Deutsche Bank shares slump 13% after huge spike in the cost of insuring against its default

This does note bode well for european banks. Deutsche Bank shares have plummeted 13% following a huge spike in the cost of insuring against its default. The world’s largest foreign exchange dealer is under intense scrutiny amid fears that it could be at risk of collapse. The German lender, which has struggled to turn around […]