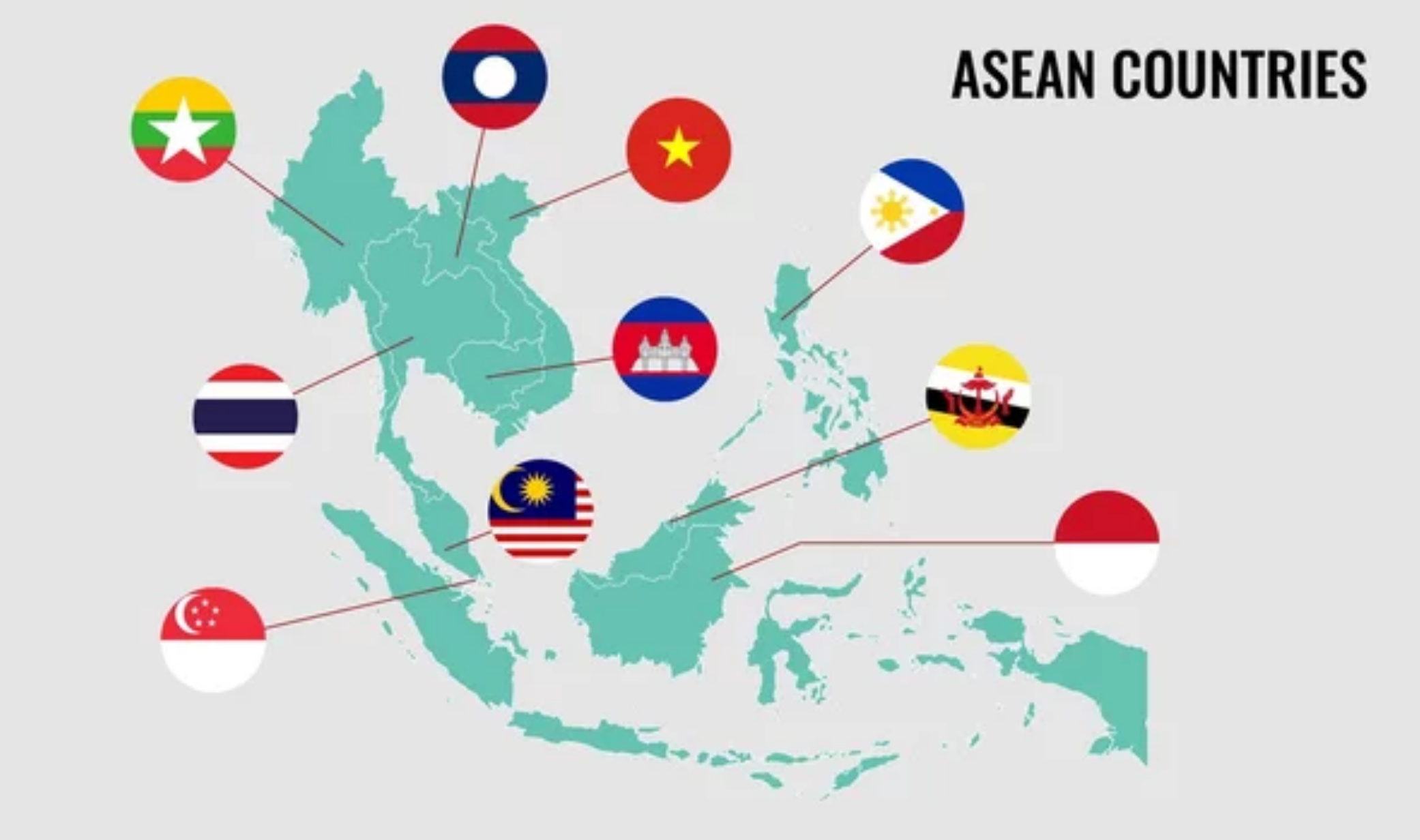

The Association of Southeast Asian Nations (ASEAN) is a regional intergovernmental organisation comprising ten countries in Southeast Asia. In recent years, there has been increasing interest among ASEAN members to reduce their reliance on the US dollar and explore alternative payment systems to VISA and Mastercard. This article discusses the reasons behind this move and its potential implications.

Introduction

ASEAN is home to some of the fastest-growing economies in the world. However, many of these countries have a high level of dollarisation, meaning that the US dollar is widely used as a medium of exchange and store of value. This is despite the fact that most of these countries have their own currencies. Additionally, many merchants in the region accept only VISA and Mastercard, which puts a strain on consumers who have to pay high fees for foreign currency transactions.

The Case Against the Dollar

One of the main arguments against the US dollar is its volatility. The dollar is subject to fluctuations in response to geopolitical events, such as the US-China trade war or tensions between the US and North Korea. This can create uncertainty for businesses and investors in ASEAN countries, whose economies are often closely tied to China.

Another issue is the dominance of the US financial system. The US dollar is used as the primary reserve currency by central banks around the world, giving the US significant influence over global financial markets. This can lead to economic sanctions and trade restrictions being imposed on countries that are not aligned with US foreign policy.

Alternative Payment Systems

In response to these challenges, ASEAN countries are exploring alternative payment systems that can reduce their reliance on the US dollar and VISA/Mastercard. One such system is the China International Payment System (CIPS), which allows for direct transactions between Chinese and foreign banks, bypassing the US dollar. Another is the Japan-led Cross-Border Payments project, which aims to develop a blockchain-based payment system that can be used across borders.

Additionally, many ASEAN countries are investing in their own digital currencies, known as Central Bank Digital Currencies (CBDCs). CBDCs have the potential to increase financial inclusion and reduce the costs of cross-border transactions.

Implications for the US and the Global Financial System

The move away from the US dollar and traditional payment systems could have significant implications for the US and the global financial system. The US dollar’s status as the world’s reserve currency has allowed the US to run large trade deficits and finance its debt at a relatively low cost. If more countries move away from the dollar, this could reduce demand for US Treasury bonds and drive up interest rates.

There are also concerns that a proliferation of alternative payment systems could lead to fragmentation in the global financial system. This could make it harder for companies to do business across borders and lead to increased volatility in financial markets.

Conclusion

ASEAN’s move away from the US dollar and traditional payment systems reflects a desire to reduce dependency on the US and diversify their financial systems. While this shift is still in its early stages, it could have significant implications for the US and the global financial system in the coming years.

FAQs

- What is ASEAN?

ASEAN is a regional intergovernmental organisation comprising ten countries in Southeast Asia.

- Why are ASEAN countries considering dropping the dollar?

There are concerns about the volatility of the dollar and the dominance of the US financial system.

- What alternative payment systems are ASEAN countries exploring?

Some of the alternatives being explored include the China International Payment System, the Cross-Border Payments project, and Central Bank Digital Currencies.

- What are the implications of this move for the US?

If more countries move away from the dollar, this could reduce demand for US Treasury bonds and drive up interest rates. It could also reduce the US’s influence over the global financial system.

- Will this shift away from the dollar happen quickly?

It is still in the early stages, but some ASEAN countries are already taking steps to reduce their dependence on the dollar and explore alternative payment systems.

- What are the potential benefits of CBDCs?

CBDCs have the potential to increase financial inclusion and reduce the costs of cross-border transactions.

- Could a proliferation of alternative payment systems lead to increased volatility in financial markets?

There are concerns that it could lead to fragmentation in the global financial system and make it harder for companies to do business across borders, which could increase volatility.

In conclusion, ASEAN countries’ consideration of dropping the US dollar and phasing out VISA and Mastercard highlights the need to diversify their financial systems and reduce dependency on the US. While this shift is still in the early stages, it could have significant implications for the US and the global financial system in the coming years. ASEAN countries are exploring alternative payment systems such as CBDCs and blockchain-based payment systems, which could increase financial inclusion and reduce the costs of cross-border transactions. However, there are also concerns that a proliferation of alternative payment systems could lead to fragmentation in the global financial system and increase volatility in financial markets.