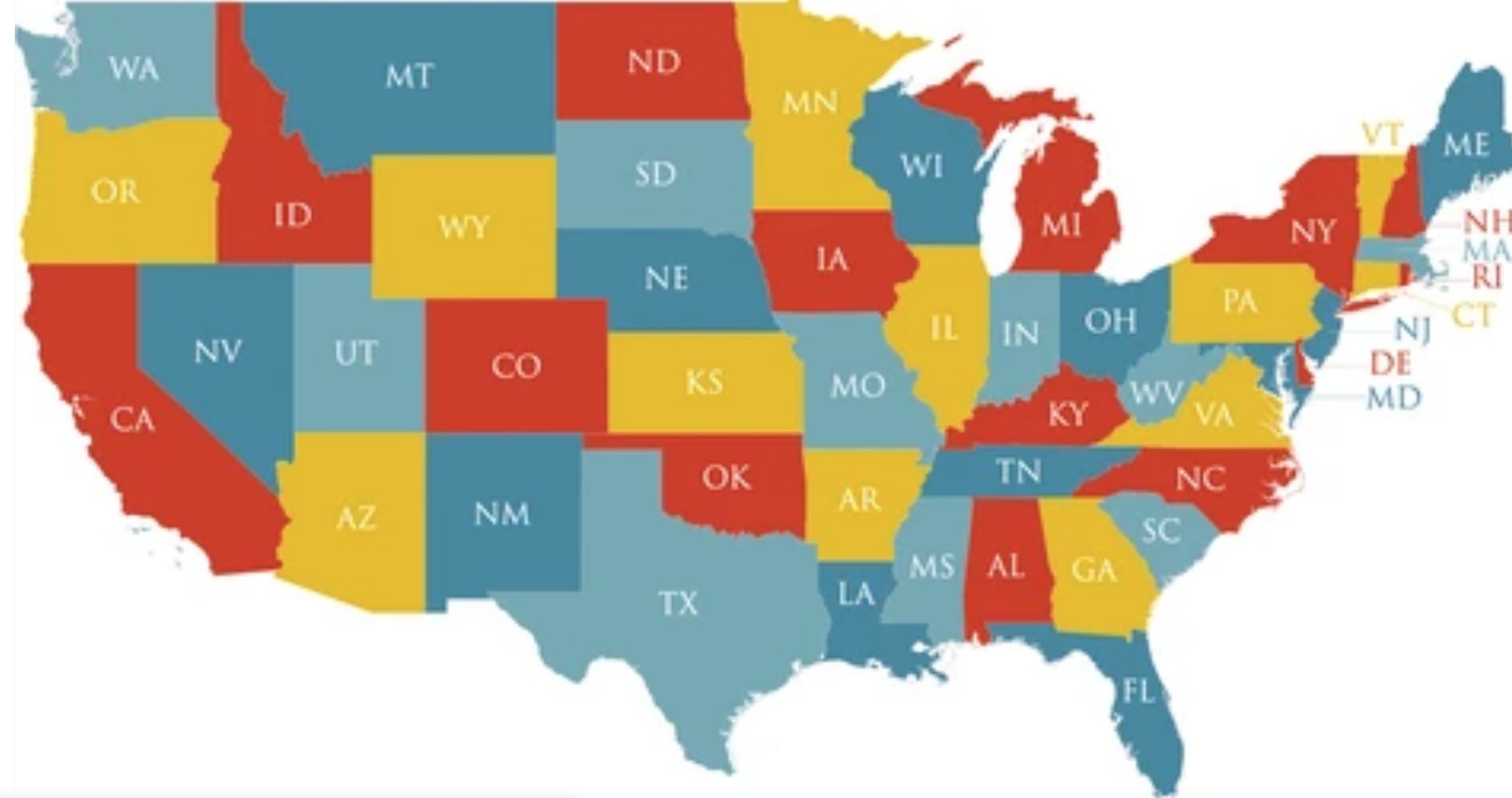

In a bold and unprecedented move, twelve states within the United States have recently declared currency independence, sparking discussions about the future of finance, state autonomy, and the evolving landscape of economics within the nation. This groundbreaking development signifies a significant shift in how states perceive and manage their economies.

Traditionally, the U.S. dollar has been the singular and universally accepted currency across all fifty states. However, the recent declaration of currency independence by a dozen states, including California, Texas, New York, Florida, and Illinois, challenges the established norm. Each state has cited various reasons for this decision, ranging from economic diversification to the desire for more localized control over financial policies.

One of the primary driving forces behind this movement is the aspiration for economic self-sufficiency. By issuing their own currencies, these states aim to bolster their local economies, stimulate growth, and reduce reliance on federal economic policies. This move also provides an opportunity for states to customize their monetary policies according to their unique economic needs, fostering innovation and adaptability.

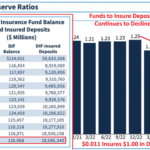

Furthermore, advocates of currency independence argue that it can lead to greater financial stability during times of economic uncertainty. By having control over their monetary systems, states can implement tailored fiscal measures, potentially mitigating the impact of national economic downturns on their local economies. This newfound flexibility offers states the ability to navigate economic challenges more effectively, enhancing their resilience in the face of global economic fluctuations.

The declaration of currency independence has ignited debates regarding its potential consequences on interstate trade and commerce. Critics express concerns about the practicality of conducting business transactions between states with different currencies. However, proponents assert that modern financial technologies, such as digital currencies and blockchain, can facilitate seamless cross-state transactions, ensuring the smooth flow of goods and services.

Additionally, this move has raised questions about the role of the federal government in regulating state economies. While the U.S. Constitution grants Congress the power to coin money, states are exercising their rights to experiment with alternative economic models. This situation presents an opportunity for a reevaluation of the balance between federal oversight and state autonomy, leading to important discussions about the future of American governance.

The international community is also closely monitoring these developments. The U.S. dollar has long been a global reserve currency, and any significant changes within the nation’s economic framework could have far-reaching implications on the global financial system. As these states move towards currency independence, they are potentially paving the way for a new era in international finance, challenging established norms and encouraging other nations to reconsider their monetary strategies.

In conclusion, the declaration of currency independence by twelve U.S. states marks a pivotal moment in the nation’s economic history. It represents not only a quest for financial sovereignty and self-sufficiency but also a reimagining of the relationship between states and the federal government. As these states embark on this uncharted journey, the world watches with anticipation, witnessing the birth of a new paradigm that could reshape the future of finance, governance, and international relations.