Introduction

The United States, often touted as the world’s economic powerhouse, is facing a financial challenge of monumental proportions. The nation’s national debt is teetering on the brink of an astonishing $33 trillion, raising concerns and sparking debates about the consequences of such a staggering financial burden. In this article, we delve into the implications of the US national debt and explore the factors contributing to this astronomical figure.

The Growing National Debt

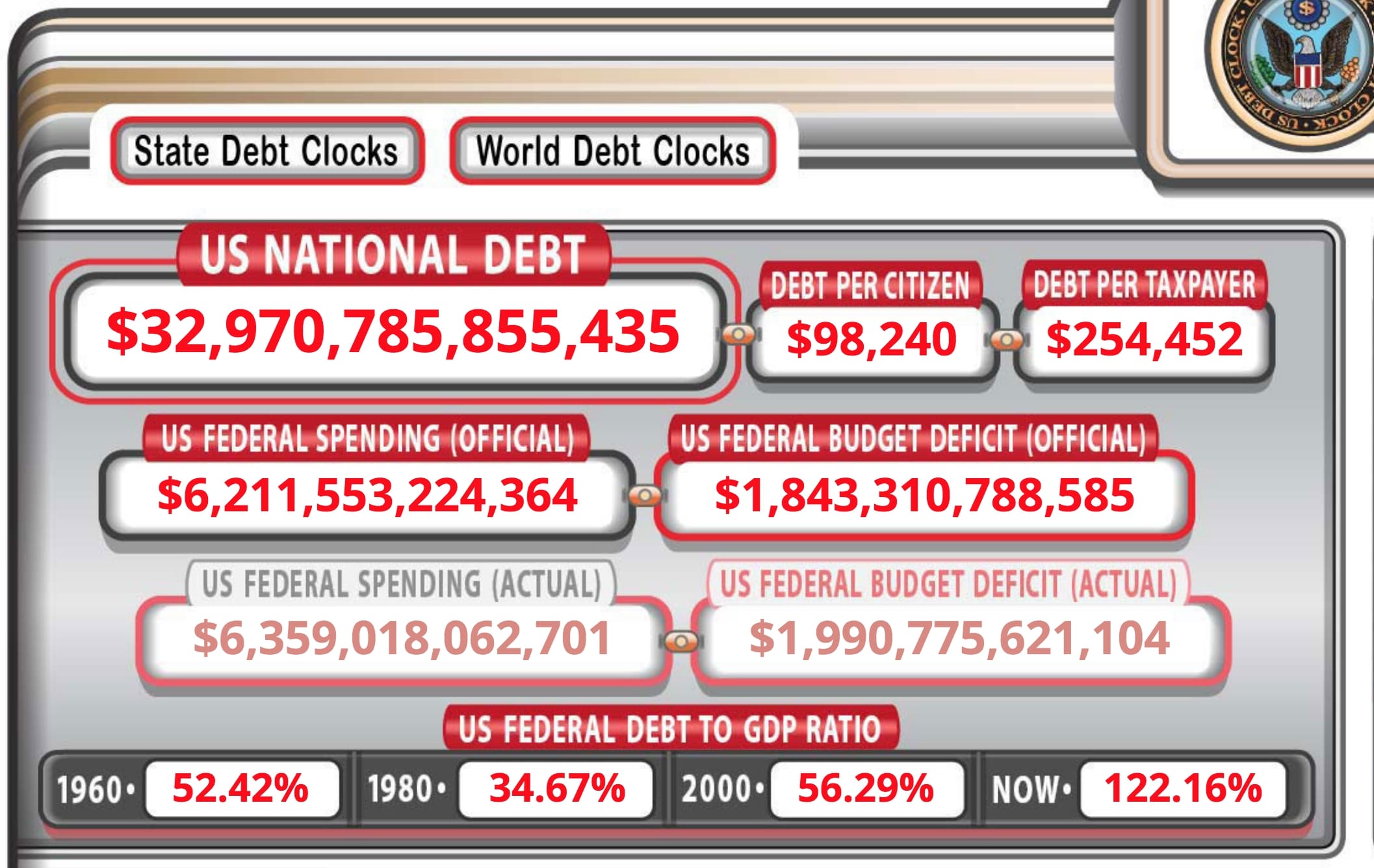

As of the latest reports, the US national debt is rapidly approaching the $33 trillion mark. This staggering number represents the cumulative amount of money the US government owes to various creditors, both domestic and international. It’s a figure so vast that it’s challenging to grasp its enormity.

Factors Contributing to the Debt

Several factors have contributed to the exponential growth of the US national debt:

1. Pandemic Spending: The COVID-19 pandemic forced the US government to implement unprecedented relief measures, including stimulus packages, unemployment benefits, and financial aid to businesses. While necessary, these measures substantially increased government spending.

2. Tax Cuts: In recent years, the US government has implemented tax cuts, aiming to stimulate economic growth. However, these cuts have resulted in reduced government revenue, exacerbating the debt problem.

3. Rising Healthcare Costs: The cost of healthcare in the US continues to climb. Government programs like Medicare and Medicaid contribute significantly to the national debt as they attempt to address the healthcare needs of millions of Americans.

4. Military Expenditure: The US maintains one of the world’s largest and most expensive military forces. Sustaining this force requires substantial financial resources, which are a significant contributor to the national debt.

5. Interest Payments: Servicing the debt itself is a significant expense. The interest on the national debt consumes a substantial portion of the federal budget, diverting resources from other critical areas.

Implications of a Growing Debt

The ballooning national debt carries several potential consequences:

1. Economic Instability: A high national debt can lead to economic instability. It can erode investor confidence, potentially resulting in higher interest rates and reduced economic growth.

2. Inflation: An excessive national debt can trigger inflationary pressures. As the government prints more money to meet its obligations, the value of the currency may decrease, leading to rising prices.

3. Reduced Government Flexibility: A significant portion of the federal budget goes toward servicing the debt. This leaves less room for government investments in critical areas like infrastructure, education, and healthcare.

4. Burden on Future Generations: The national debt is essentially a financial burden passed on to future generations. It may limit their ability to invest in their own economic well-being.

Conclusion

The US national debt’s inexorable march toward $33 trillion serves as a stark reminder of the financial challenges facing the nation. Addressing this issue will require careful fiscal management, including a focus on both reducing government spending and increasing revenue. While the full implications of such a colossal debt load remain uncertain, it is clear that it will have far-reaching consequences for the US economy and the generations to come. Finding a sustainable path forward is essential to ensure economic stability and prosperity.