Introduction

China’s decision to sell U.S. debt and invest in gold has generated significant interest and raised numerous questions about the potential implications for both countries and the global economy. This article explores the motivations behind China’s actions, the impact on the U.S. economy, and the potential consequences of this strategic shift. By examining the factors driving China’s decision, we can gain valuable insights into the evolving dynamics of global financial markets.

Table of Contents

- Introduction

- China’s Motivations for Selling U.S. Debt

- The Impact on the U.S. Economy

- China’s Gold-Buying Spree

- Implications for Global Financial Markets

- Conclusion

- Frequently Asked Questions (FAQs)

China’s Motivations for Selling U.S. Debt

China’s decision to sell U.S. debt stems from a combination of economic and geopolitical considerations. One key factor is the desire to diversify its foreign exchange reserves and reduce its exposure to the U.S. dollar. By holding significant U.S. debt, China has become vulnerable to currency fluctuations and potential devaluation. Selling U.S. debt allows China to reallocate its resources and mitigate such risks.

Additionally, China’s growing economic strength and its ambition to establish the yuan as a global reserve currency have played a role in this strategic move. By reducing its U.S. debt holdings, China can enhance the attractiveness of its own currency and increase its influence in international trade and finance.

The Impact on the U.S. Economy

China’s decision to sell U.S. debt can have several implications for the U.S. economy. Firstly, it may lead to an increase in interest rates as the demand for U.S. bonds weakens. This could affect borrowing costs for the U.S. government and other borrowers, potentially slowing economic growth.

Furthermore, a significant sell-off of U.S. debt by China could put downward pressure on the U.S. dollar. A weaker dollar would make imports more expensive, potentially leading to higher inflation. It could also impact the competitiveness of U.S. exports, making them more attractive in global markets.

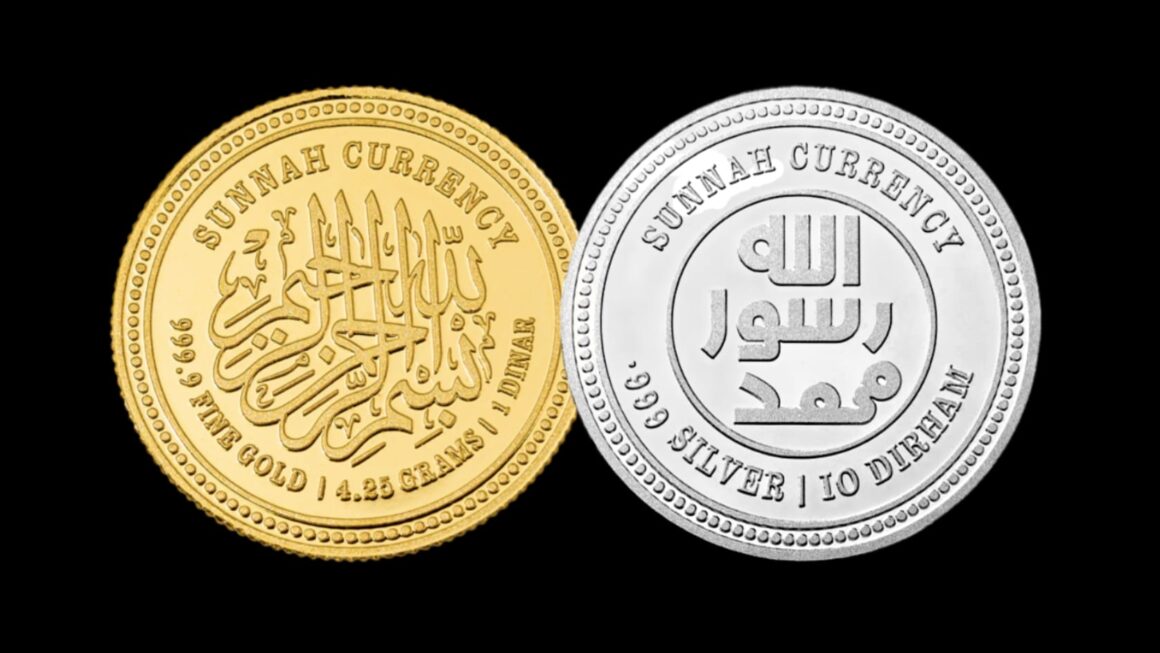

China’s Gold-Buying Spree

In recent years, China has been actively buying gold as part of its strategy to diversify its reserves. Gold is considered a safe-haven asset that provides stability during times of economic uncertainty. By purchasing gold, China aims to protect its wealth and reduce its dependence on traditional reserve currencies.

China’s gold buying spree not only bolsters its financial security but also has geopolitical implications. The country’s increasing gold reserves give it greater leverage in international negotiations and strengthen its position as a global economic power.

Implications for Global Financial Markets

China’s shift from U.S. debt to gold has broader implications for global financial markets. It challenges the longstanding dominance of the U.S. dollar as the world’s primary reserve currency and introduces a potential alternative in the form of the yuan.

The reduced demand for U.S. debt by China could impact interest rates, currency exchange rates, and the stability of global financial markets. It may also lead other countries to reevaluate their own holdings of U.S. debt and consider diversifying their reserves.

Conclusion

China’s decision to sell U.S. debt and invest in gold reflects its strategic efforts to reduce reliance on the U.S. dollar, enhance the yuan’s role in global trade, and safeguard its financial stability. This move has the potential to reshape the dynamics of the global economy, impacting interest rates, currency exchange rates, and the standing of reserve currencies.

As China continues its gold-buying spree, other countries may follow suit, diversifying their reserves and potentially reducing the dominance of the U.S. dollar. The long-term implications of these actions are yet to be fully realized, but they undoubtedly mark a significant shift in the global financial landscape.

Frequently Asked Questions (FAQs)

1. What are the reasons behind China’s decision to sell U.S. debt?

China aims to diversify its foreign exchange reserves, reduce exposure to the U.S. dollar, and strengthen its own currency’s global influence.

2. How will China’s sell-off of U.S. debt impact the U.S. economy?

It could lead to higher interest rates, a weaker U.S. dollar, and potential challenges for U.S. exports and borrowing costs.

3. Why is China buying gold?

China purchases gold as a safe-haven asset to protect its wealth, reduce reliance on traditional reserve currencies, and strengthen its geopolitical position.

4. What are the broader implications of China’s actions for global financial markets?

China’s shift from U.S. debt to gold challenges the dominance of the U.S. dollar, potentially impacting interest rates, currency exchange rates, and the stability of global financial markets.

5. How might other countries react to China’s actions?

Other countries may consider diversifying their reserves, reducing their reliance on the U.S. dollar, and exploring alternative investments to safeguard their financial stability.