The United States is Facing a Critical Financial Predicament

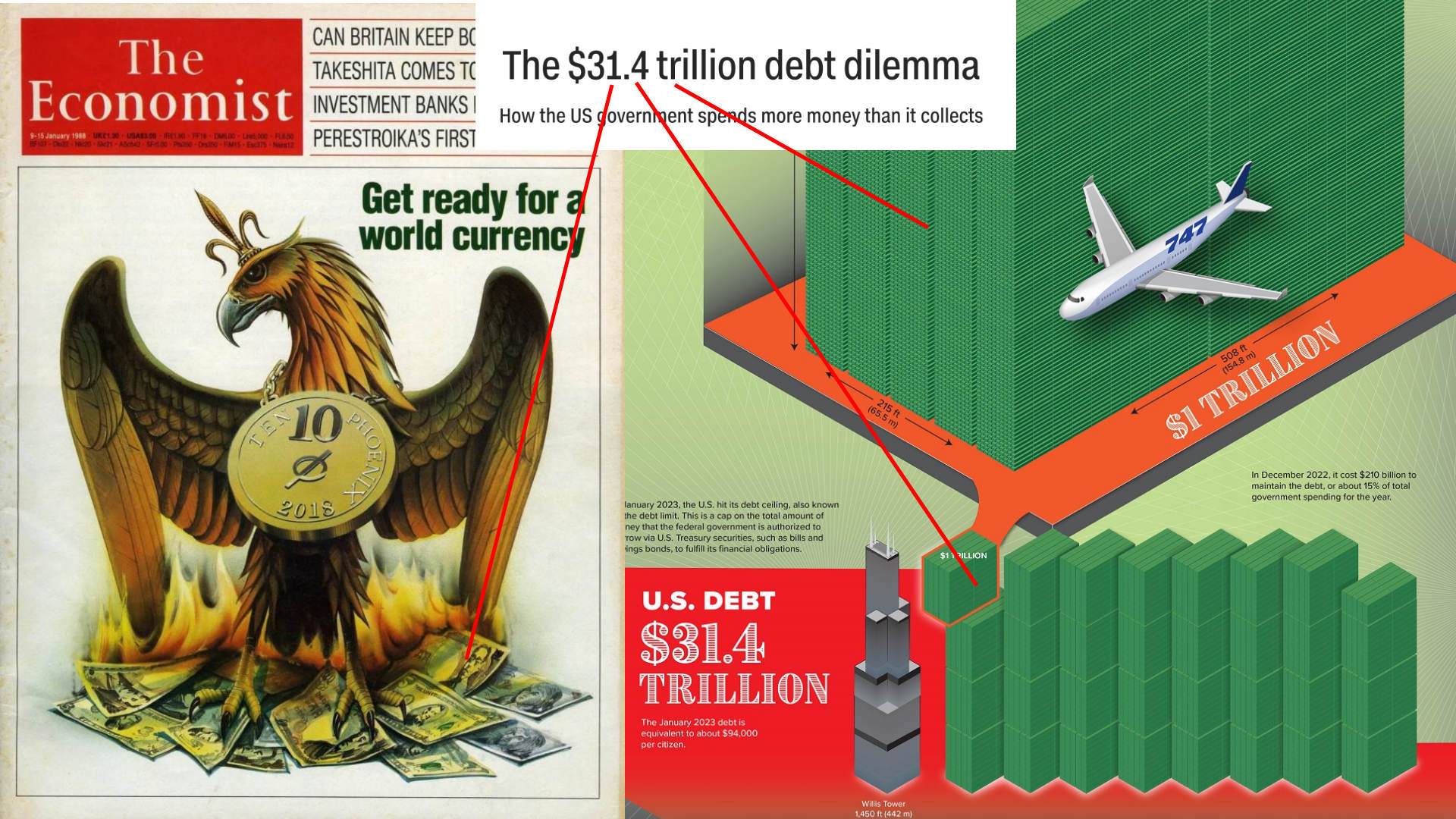

The United States is facing a critical financial predicament that could result in default within the next month, according to the US Treasury. The nation’s debt ceiling, which was set at $31.4 trillion in January, has already been reached, necessitating the urgent need for a debt limit increase.

What is the Debt Ceiling?

The debt ceiling is the legal limit on the amount of money that the US government can borrow to pay for its expenses. It is determined by Congress and is intended to ensure that the government does not spend more money than it can afford. If the government reaches the debt ceiling, it cannot borrow any more money until the limit is increased or suspended.

The debt ceiling has been in place since 1917 and has been raised many times over the years to accommodate government spending. However, it has also been a source of political contention, with debates often centring around government spending, deficits, and debt.

Why Has the Debt Ceiling Been Reached?

The debt ceiling has been reached due to a combination of government spending and revenue. The government has been running large deficits for many years, meaning that it spends more money than it brings in through taxes and other sources of revenue. The COVID-19 pandemic has also had a significant impact on government finances, with trillions of dollars in relief spending and reduced tax revenue.

If the debt ceiling is not raised, the government will not be able to borrow more money to pay for its expenses, including salaries for federal employees, payments to contractors, and interest on the national debt. This could have serious economic consequences, both in the US and around the world.

Consequences of Not Raising the Debt Ceiling

If the debt ceiling is not raised, the US government could default on its financial obligations. This could lead to a number of economic impacts, including a significant increase in interest rates, a drop in the value of the US dollar, and a reduction in US economic growth. It could also have a ripple effect on global markets, as US Treasury bonds are widely held by investors around the world.

In addition to the economic impacts, a failure to raise the debt ceiling could also have a significant impact on government programs and services. The government may be forced to delay or cut payments to federal contractors, leading to delays in important projects and services. It could also lead to cuts in social programs, such as Medicare and Social Security, which could have a significant impact on vulnerable populations.

The Current Political Landscape

The current political landscape surrounding the debt ceiling is complex. The two major political parties, Democrats Certainly, In addition to the immediate economic consequences of a default, there could be long-term damage to the United States’ reputation and financial standing. Defaulting on its obligations could harm the country’s ability to borrow money in the future, leading to higher interest rates, reduced investment, and decreased economic growth. The impact of a default could be felt for years to come, affecting not only the United States but also the global economy.

To address this issue, Congress must take action to increase or suspend the debt limit before it is too late. Failure to act in a timely manner could have dire consequences for the country and its citizens.

In conclusion, the United States is currently facing a critical financial predicament that demands immediate attention. Failure to increase or suspend the debt limit could result in default within the next month, causing severe economic consequences for the country and the world. Congress must act quickly to prevent this outcome and ensure the stability of the economy for years to come.

FAQs:

-

What is the debt ceiling? The debt ceiling is the maximum amount of money that the United States government is authorised to borrow to meet its financial obligations.

-

What happens if the debt ceiling is not increased? If the debt ceiling is not increased, the federal government may be unable to fulfil all of its financial obligations, potentially leading to default.

-

What are the consequences of defaulting on financial obligations? Defaulting on financial obligations could harm the country’s ability to borrow money in the future, leading to higher interest rates, reduced investment, and decreased economic growth.

-

Why is it critical for Congress to act quickly on this issue? Congress must act quickly to prevent default and ensure the stability of the economy for years to come. Failure to act in a timely manner could have dire consequences for the country and its citizens.

-

What can individuals do to support action on the debt limit? Individuals can contact their elected representatives and express their support for increasing or suspending the debt limit to prevent default and ensure the stability of the economy.